Blink and you might have missed it.

The bars at the bottom of the chart are volume for a 5-minute period.

The red (?) and black (framed in red lines) are price action.

Solid bars mean the price declined during the 5-minute period as compared to the previous 5 minutes.

The volume rises at the open: 630 am PST/ 930 am EST.

The price rises, too.

Like a good trader I buy puts at the open because my Delta has spikjed and I, as you might recall (It was only yesterday-oh! welcome new readers-), trade to keep my gamma above my delta. Which with a price surge as we can see occurred, means buying puts or selling calls.

I have 2 In the money puts that have a lot of theta, so I bought out of the money, 1-month puts and calculated my new delta.

Then, the storm arrived.

A wild collapse in price? Check.

A massive rise (or fall) in volatility? Check.

A sudden move that breaks technical barriers? Check.

A blip? No. A glitch? No.

Something unexplained? No.

Gamma moved from being c. 2x the Delta to 3x in well, about 15 minutes.

If you look at the chart again you can see the sudden fall interrupted by a small jump and then another smaller decline.

Now, sign up to Options Trading, Futures & Stock Trading Brokerage | tastytrade and waste your precious time back testing that particular phenomenon against long volatility/long gamma positions and see how profitable understanding the term structure of volatility is versus what every day, run of the mil retail brokerage sites tell you about Options trading.

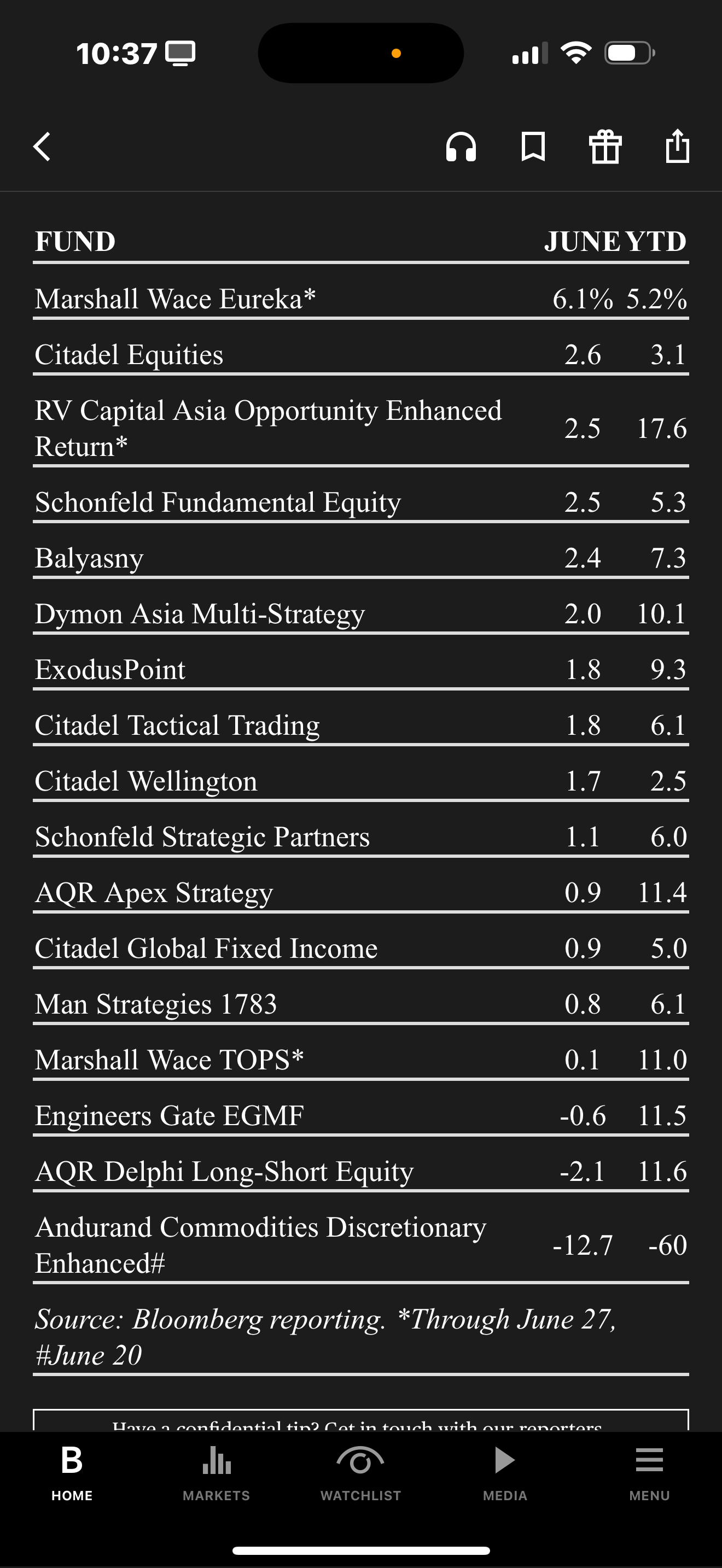

Or look at these charts.

Top hedge fund performances: you can see the source and the date at the footer.

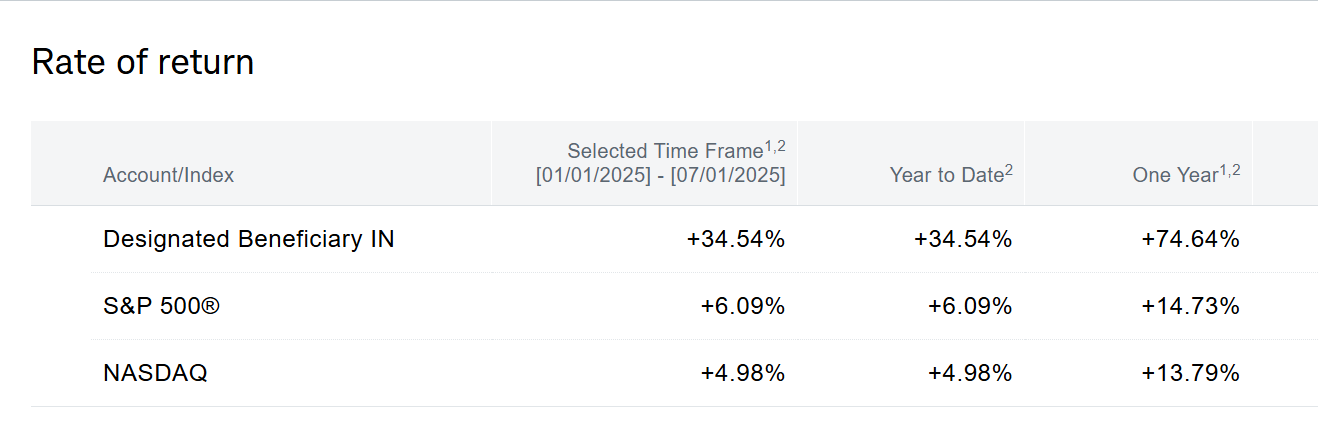

These are my results, on Equity and Equity derivatives alone:

Brokers will warn you that 90% of Options expire worthless. Or that only 10% of Options are profitable. Here are my numbers (like a batting average), YTD and over the last year:

While I do not watch it, I have a long history understanding baseball because it is a great way to learn the mathematics behind Options trading and always have something to talk about with your estranged father.

I know how much batting averages above .300 is worth:

The most recent MLB player to win the Triple Crown is Miguel Cabrera, who achieved this feat in 2012. He led the American League in batting average (.330), home runs (44), and RBIs (139) that season5.

$20.6 million

In 2012, Miguel Cabrera's salary was $20.6 million. This figure reflects his earnings during that season as part of his contract with the Detroit Tigers2.

Baseball is certainly worth more than Options trading but hopefully you get my very simple point:

I started trading future and options before I graduated high school. I got Series 3 license as soon as possible, after my 21st birthday, and moved to NYC knowing 1 person, with a small trading account and a budget of 300 dollars per week. I survived my first week on 50 dollars, waiting for paperwork to process and checks to clear.

I was the youngest Officer in Chase history. I was the last person to graduate (I legitimately passed while having to work through a 1994 Yen crisis) the Chase Trading Floor Development Program without an MBA. I was the youngest VP in CIBC history. I was the youngest hedge fund manager Julius Bar ever backed.

In 1994, I invented a way to arbitrage cash BTPs versus the futures. That is how I ended up at CBA in 1996.

I have been trading, 1 way or another, for over 30 years. With a perfect memory.

I have made money. I have lost money. I have wished I’d stayed in bed. I have met and learned from the best.

So, as I watched the gamma storm erupt this morning (the S&P 500 futures had a similar experience at the same time) I smiled knowing:

I had seen the signs.

I was prepared.

I had done what Dominic Larche, Sarangan Chari, Chris Vogel, Chris Heasman, and Chris Goggins had taught me to do: do my homework, be at my ‘post’, and follow the mathematics.

This is why the equity in the Short NKE position, with gamma higher than delta, has doubled despite the rally in NKE since earnings were announced.

I also sold in the money calls today, replacing them with longer dated, out of the money calls. A way to take profits to finance insurance trades. Especially as the market moves against me.

No, these are not naked options. This was profit taking at over 3x.

So, as you can see by the chart above. NKE continued to surge higher after earnings, renewed confidence in management, and the announcement of a trade deal with Vietnam.

The market ignored the spike in volatility, the rise in the PUT:CALL ratio, and the crisis in Thailand.

To be continued…