Everyone who invests and trades and pays close attention experiences something bizarre each weekend.

The hands of thieves.

Brokers who pay interest on cash and holdings (all of them) play a parlor trick to reduce the amount they have to pay interest on.

How do they do this?

The typical exchange and institution revaluation process, also known as marked to market of your positions is based on the midpoint between the closing bid (where the market will buy) and ask/offer (where the market will sell).

for example, as is often the case in Russel 200 based derivatives (MRUT), if the closing prices for Out of the money options is 0 bid 10 officered then the closing price is 5.

The broker, throughout the week is probably happy to leavethis mark alone as changing it is both illegal and immoral.

On Fridays, though, they value positions at the ‘;last’ traded price. In dark markets and derivatives this can mean that an instrument might not have traded since Wednesday. If the market traded 2 on Wednesday, then that is where they will price.

Strangely, they often use a footnote:

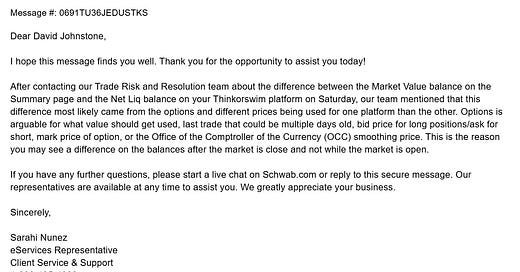

I have contacted them on multiple occasions over the last few years to get more understanding of their illegal and immoral policy and this is the most detailed response to date:

So, what is happening? Well, this is one small instance that causes discrepancies in banking, brokerage, and savings accounts all over the world: the war between accounting and market dynamics.

The accountants manipulate the balances with archaic methods to value while market dynamics cannot be manipulated. The price is the price is the price.

The value is very different. I will not quote Oscar Wilde here, but you get the point.

Now you might think this is exclusive to derivatives markets. It is not.

There are no markets until Monday.

To be continued…